The Asaan Karobar Scheme is a great initiative launched by the Punjab Government to support small business owners and young entrepreneurs. This scheme provides interest-free loans ranging from PKR 100,000 to PKR 1,000,000 to help individuals start or expand their businesses. It aims to reduce unemployment and promote financial stability by encouraging self-employment. The process is simple, and applicants can easily check their loan status through the AKC Portal. In this article, we will explain how to check your application status, the benefits of the scheme, who can apply, and share useful tips to avoid rejection and delays.

| Feature | Details |

| Loan Amount | PKR 100,000 to 1,000,000 |

| Repayment Time | 3 years (with 3-month grace period) |

| Application Method | Online through AKC Portal |

| Requirement | Must be resident of Punjab with clean credit |

Table of Content

- 1 What is the Asaan Karobar Scheme?

- 2 Benefits of the Asaan Karobar Scheme

- 3 Who Can Apply for Asaan Karobar Scheme?

- 4 How to Check Asaan Karobar Scheme Application Status Through AKC Portal

- 5 Common Reasons for Application Rejection

- 6 Tips for a Successful Asaan Karobar Scheme Application

- 7 Conclusion

- 8 FAQs

What is the Asaan Karobar Scheme?

The Asaan Karobar Scheme is a government project that helps young people and small business owners in Punjab. Under this scheme, you can get an interest-free loan between 1 lakh to 10 lakh rupees. The purpose is to help people start or improve their businesses. The loan can be paid back over three years in easy monthly payments. Applicants can also use up to 25% of the loan in cash. The rest should be used for your business, like paying bills, buying products, or using digital payment systems.

Benefits of the Asaan Karobar Scheme

This scheme offers many good benefits for new and small business owners.

- The loan is completely interest-free, with no hidden charges.

- The repayment period is three years, along with a grace period of three months.

- The loan can be used for business expenses like utility bills, equipment, or digital payments.

- You can access funds using mobile apps or POS machines for convenience.

Who Can Apply for Asaan Karobar Scheme?

To apply for this scheme, you must meet the eligibility rules given below.

- Your age should be between 21 and 57 years.

- You must be a permanent resident of Punjab.

- Your business must be located in Punjab.

- You should not have any overdue loans or a poor credit history.

- You must register your business with PRA or FBR within six months after loan approval.

- Only one application is allowed per person or business.

- You must pass a credit and psychometric test.

Also Read: Benazir Taleemi Wazifa Document Verification Through BISP Tehsil Office 2025 [Latest Update April]

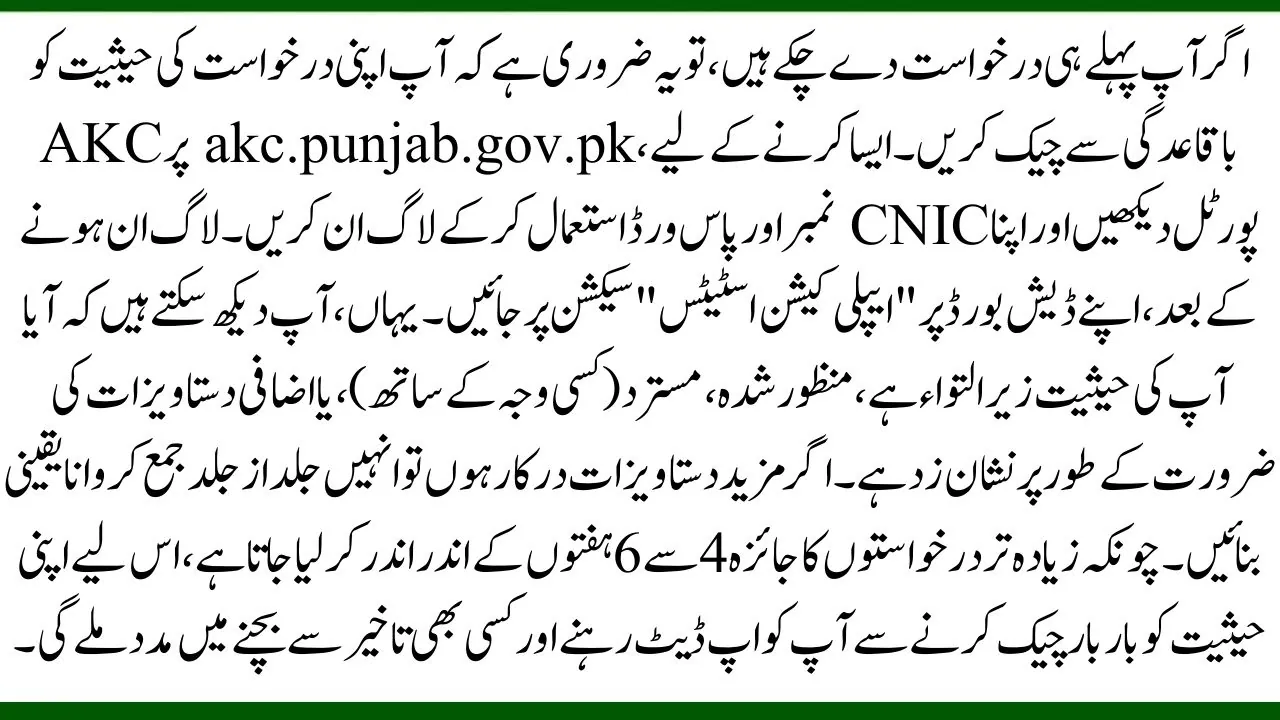

How to Check Asaan Karobar Scheme Application Status Through AKC Portal

If you have already applied, it is important to keep checking your status. Follow these simple steps.

- Visit the AKC Portal at akc.punjab.gov.pk.

- Login to account using CNIC number and password.

- Go to the “Application Status” section on your dashboard.

- Check if your status is Pending, Approved, Rejected (with reason), or Needs Documents.

- If additional documents are required, submit them as soon as possible.

Most applications are reviewed within 4 to 6 weeks, so make sure to check your status regularly.

Common Reasons for Application Rejection

To avoid having your application rejected, make sure you avoid these common issues.

- Missing documents such as CNIC or business registration details.

- Age not within the 21 to 57 years range, or not being a resident of Punjab.

- Bad credit history or existing unpaid loans.

- Failing to register your business with PRA/FBR within 6 months after approval.

Tips for a Successful Asaan Karobar Scheme Application

Here are a few helpful tips to improve your chances of approval.

- Double-check that you meet all the eligibility conditions.

- Prepare and organize all necessary documents in advance.

- Complete the PRA or FBR registration after loan approval.

- Regularly check your application status and respond quickly if any updates are required.

- Stay active on the portal and keep your login details safe.

Also Read: BISP 13500 Payment Notifications April 2025 Update – Check Payment Dates & Eligibility

Conclusion

In this article, we are sharing all the details about how to check your Asaan Karobar Scheme application status through the AKC portal. We also explained the benefits, who can apply, how to check the status, and how to avoid rejection. The Asaan Karobar Scheme is a golden chance for the youth and small business owners of Punjab to grow their businesses with interest-free loans. If you are eligible, apply now through akc.punjab.gov.pk and begin your journey to financial success.

FAQs

Can I apply again if my application was rejected?

Yes, you can apply again after correcting the issue that caused the rejection.

What documents are needed for the application?

You need your CNIC, mobile number, and business information. You also must register with PRA/FBR after approval.

Can I get the loan in cash?

You can withdraw up to 25% of the total loan in cash. The rest must be used for your business through digital methods.

Is this scheme only for new businesses?

No, both new and running businesses in Punjab can apply, as long as they meet the eligibility rules.